In the ever-evolving world of insurance, accuracy in damage assessment is crucial. It not only ensures fair compensation for the insured but also helps insurance companies maintain their reputation and financial health. With the advent of advanced technologies, companies like Garud Survey have revolutionized damage mapping, making claims more precise and reliable. This article delves into the intricacies of Garud Survey’s advanced damage mapping techniques and their impact on the insurance industry.

The Importance of Accurate Damage Mapping in Insurance

Accurate damage mapping is the backbone of the insurance claims process. When a policyholder files a claim, the insurer must determine the extent of the damage to assess the appropriate compensation. Inaccurate assessments can lead to disputes, increased costs, and loss of trust. Therefore, investing in precise damage mapping tools and methods is essential for both insurers and policyholders.

Introduction to Garud Survey

Garud Survey is at the forefront of innovative surveying solutions. With a focus on leveraging cutting-edge technology, Garud Survey provides comprehensive damage mapping for insurance services that cater to the needs of the modern insurance industry. Their solutions are designed to enhance accuracy, reduce turnaround times, and improve overall efficiency in the claims process.

Advanced Damage Mapping Techniques

Garud Survey employs a range of advanced techniques to ensure high accuracy in damage assessments. These include:

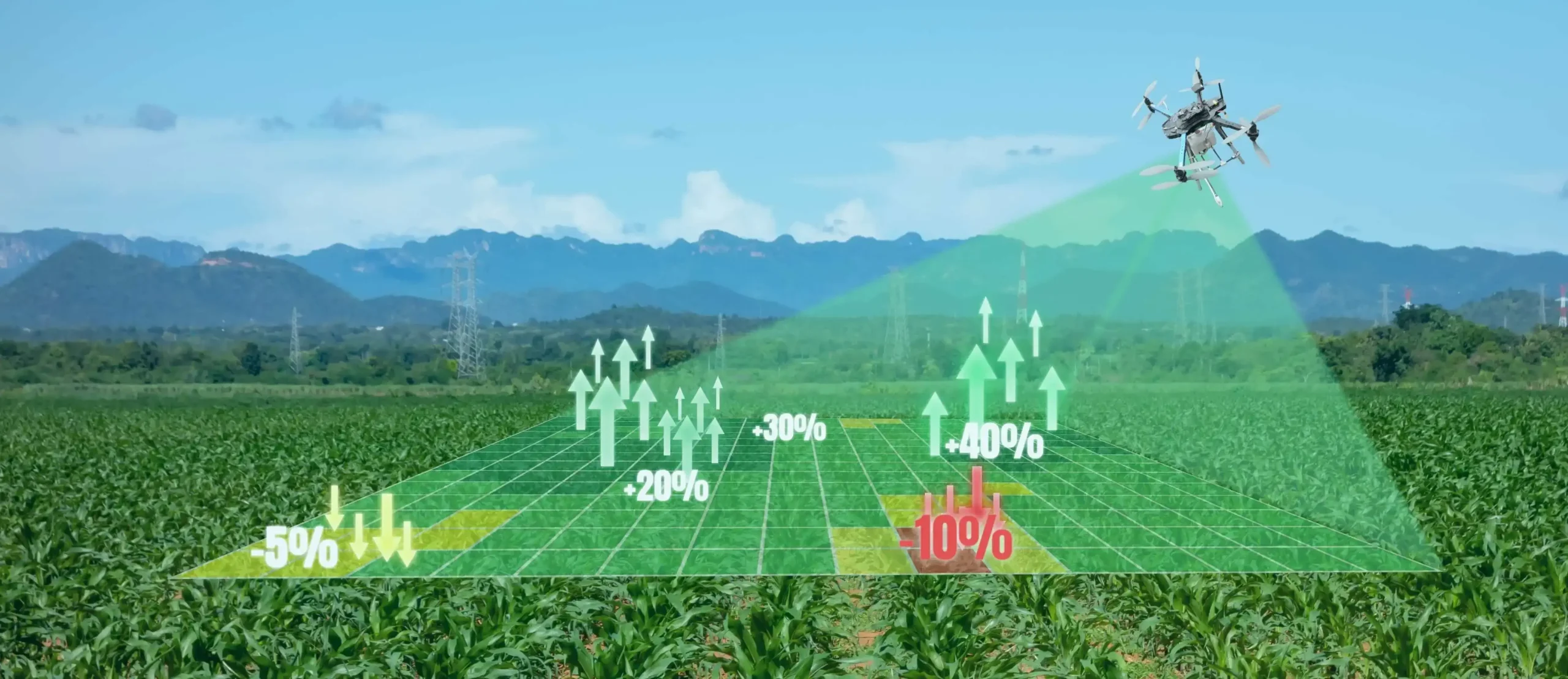

1. Aerial Drone Surveys

One of the standout technologies used by Garud Survey is aerial drone surveys. Drones equipped with high-resolution cameras and sensors can quickly capture detailed images of the affected area. These images are then processed to create accurate 3D models and maps.

2. LiDAR Technology

Light Detection and Ranging (LiDAR) is another critical tool in Garud Survey’s arsenal. LiDAR systems use laser pulses to measure distances and generate precise, high-resolution maps of the terrain and structures. This technology is particularly useful in assessing damage in areas that are difficult to reach or dangerous to survey manually.

3. Photogrammetry

Photogrammetry involves the use of photography to measure distances between objects. By analyzing multiple images taken from different angles, Garud Survey can create detailed and accurate representations of the damaged areas. This method is invaluable for assessing large-scale damage, such as in natural disasters.

4. Thermal Imaging

Thermal imaging cameras detect heat patterns and can identify hidden damage that may not be visible to the naked eye. This technology is especially useful for detecting issues like water intrusion, electrical faults, and structural weaknesses.

Benefits of Using Advanced Damage Mapping for Insurance

The use of advanced damage mapping techniques offers several benefits for the insurance industry, including:

1. Improved Accuracy

The primary benefit is the improved accuracy of damage assessments. Advanced technologies like drones, LiDAR, and thermal imaging provide precise data that can significantly reduce errors and inconsistencies in claims processing.

2. Faster Turnaround Times

With traditional methods, damage assessments can be time-consuming. Advanced mapping technologies expedite the process by quickly gathering and analyzing data, leading to faster turnaround times for claims.

3. Cost Efficiency

By reducing the need for extensive manual inspections and minimizing errors, advanced damage mapping can lead to significant cost savings for insurance companies. This efficiency can be passed on to policyholders through lower premiums and better service.

4. Enhanced Customer Satisfaction

Accurate and swift claims processing enhances customer satisfaction. Policyholders are more likely to trust and remain loyal to insurers who handle their claims efficiently and fairly.

5. Risk Mitigation

Advanced damage mapping also helps in risk mitigation. By providing detailed and accurate assessments, insurers can better understand potential risks and take proactive measures to prevent future losses.

Case Studies: Success Stories with Garud Survey

Several insurance companies have successfully integrated Garud Survey’s advanced damage mapping into their claims processes. Here are a few notable examples:

1. Natural Disaster Response

In the aftermath of a major hurricane, an insurance company utilized Garud Survey’s drone and LiDAR technology to assess widespread damage quickly. The accurate and comprehensive data collected enabled the company to process thousands of claims efficiently, helping policyholders rebuild their lives faster.

2. Urban Infrastructure Damage

A leading insurer in a metropolitan area faced challenges in assessing damage to urban infrastructure following a severe storm. Garud Survey’s photogrammetry and thermal imaging solutions provided detailed insights into the extent of the damage, facilitating prompt and accurate claims processing.

3. Remote Area Assessments

An insurance firm dealing with claims in remote and inaccessible areas turned to Garud Survey for assistance. The use of drones and LiDAR technology allowed the company to overcome logistical challenges and deliver accurate damage assessments, ensuring fair compensation for policyholders.

Integrating Garud Survey’s Solutions into Your Insurance Workflow

Integrating Garud Survey’s advanced damage mapping solutions into your insurance workflow is a strategic decision that can yield significant benefits. Here are some steps to consider:

1. Assess Your Needs

Start by assessing your current damage assessment processes and identifying areas where advanced technologies can make a difference. Determine the specific needs of your organization and how Garud Survey’s solutions can address them.

2. Partner with Garud Survey

Establish a partnership with Garud Survey to leverage their expertise and technology. Work closely with their team to customize solutions that align with your operational requirements and objectives.

3. Training and Implementation

Invest in training your staff to effectively use the new technologies. Garud Survey provides comprehensive training programs to ensure smooth implementation and optimal utilization of their solutions.

4. Monitor and Evaluate

Once the advanced damage mapping solutions are in place, continuously monitor their performance and evaluate their impact on your claims process. Use this data to make informed decisions and further refine your strategies.

The Future of Damage Mapping in Insurance

The future of damage mapping in the insurance industry looks promising, with ongoing advancements in technology poised to further enhance accuracy and efficiency. Here are some trends to watch:

1. Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are set to play a significant role in damage mapping. These technologies can analyze vast amounts of data quickly, identifying patterns and anomalies that may not be apparent to human assessors. AI and ML can also help in predictive analysis, providing insights into potential risks and enabling proactive measures.

2. Integration with IoT Devices

The Internet of Things (IoT) is increasingly being integrated into damage assessment processes. IoT devices, such as sensors and cameras, can continuously monitor properties and provide real-time data on their condition. This integration allows for immediate damage detection and assessment, further speeding up the claims process.

3. Enhanced Data Analytics

Advanced data analytics tools are becoming more sophisticated, enabling insurers to process and interpret damage assessment data more effectively. These tools can provide deeper insights into the causes and extent of damage, helping insurers make more informed decisions.

4. Greater Collaboration

There is a growing trend towards greater collaboration between insurers, technology providers, and other stakeholders in the damage assessment ecosystem. By working together, these entities can develop more comprehensive and effective solutions to meet the evolving needs of the industry.

Conclusion

In the competitive and complex landscape of the insurance industry, damage mapping for insurance is essential for fair and efficient claims processing. Garud Survey’s advanced damage mapping techniques, including aerial drone surveys, LiDAR technology, photogrammetry, and thermal imaging, provide the precision and reliability needed to enhance claims accuracy. By integrating these innovative solutions into their workflows, insurance companies can improve customer satisfaction, reduce costs, and mitigate risks.

As technology continues to evolve, the future of damage mapping in insurance looks bright. Embracing advancements such as AI, IoT, and enhanced data analytics will further enhance the accuracy and efficiency of damage assessments, setting new standards in the industry. For insurers looking to stay ahead of the curve, partnering with leaders like Garud Survey is a strategic move towards achieving excellence in claims management.